How to Compare the Yields of Different Bonds in 2022?

Advertisement

Triston Martin

Nov 12, 2023

To evaluate different fixed-income securities, You'll have to determine the yield to maturity. This is the sum of the price at which you purchase the bond with the coupon rate and represents the purchaser's actual return on investment. Bonds can be traded and quoted according to a yield-to-maturity basis, which is the basis from which the purchase price is able to be calculated. If bonds are traded on the ASX and are traded and quoted on a cost basis as well as the rate of return could be calculated in reverse. This article tells you how to compare the yields of different bonds.

What Are Bonds?

In their simplest form, they are essentially an instrument of borrowing. If a company needs to raise huge quantities of capital, they usually take loans from the general public. In the modern world, it could be considered similar to crowd-funding. For instance, if an organization or government requires funds to improve operations or services, they'll issue bonds on the market. If you decide to purchase the bonds, you're lending the company part of the capital they're trying to raise in exchange; you (the bondholder) will receive an annual interest for the loan duration. Then, when the bond is due to mature, the company pays you back the loan amount and the amount of face value.

Factors to Take into Account when Comparing Yields on Bonds

U.S. Treasury bills (T-bills) and corporate commercial paper investments are traded on an interest-based basis. The investor is not able to receive any interest coupons. The gain is the difference between the value at the time of purchase and the face value at maturity. This is called the implicit interest rate.

The discount is expressed in percentages of the face value. This is then yearly adjusted over 360 days. It is better to consider the rate of return as the amount of interest earned divided by the price at present, not that of the value on its face. Since the T-bill was purchased at a lower price than its face price, the denominator is excessively high, and discounts are not sufficiently accounted for. The other issue comes from the fact that it is calculated on a hypothetical year which includes less than 360 days.

Bond Yield Conversions

The following can help you compare bond yields:

· 365 Days versus 360 Days

It is essential to apply the exact yield calculation to evaluate the yields of different fixed-income investments. The first and simplest change is to convert an annual yield of 360 days to a 365-day one. To alter the yield, just "gross increase" the yield of the 360 days by the number 360/365. A yield of 8 percent equals a 365-day yield of 8.11 percent.

· Discount Rates

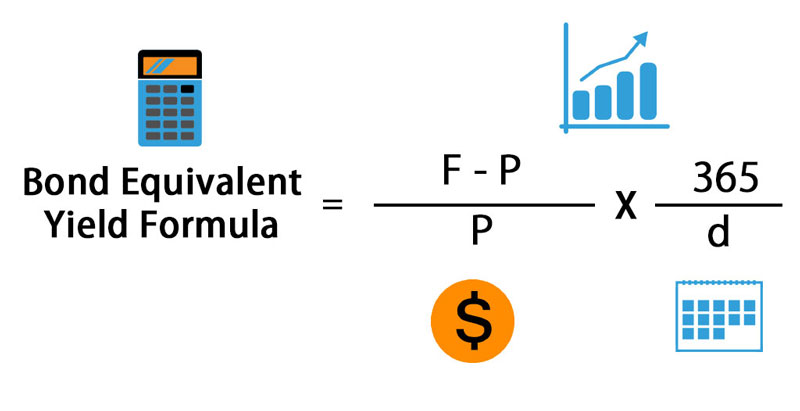

Discount rates, typically used on T-bills, are usually changed to a bond equivalent yield (BEY) which is sometimes referred to like the term "investment yield. The conversion formula is for "short-dated" bills that have maturities of 182 days or less.

· Long Dates

T-bills, also known as "long-dated" bills, have an expiration date of more than 182 days. In this situation, the standard conversion formula can be more complicated due to compounding.

· Short Dates

The implicit accumulating period in the BEY for short-dated T-bills is the interval between settlement and maturity. However, the BEY of the T-bill with an extended date does not contain a well-defined compounding principle, which makes its understanding difficult. BEYs are generally lower than the average annualized yields of semi-annual compounding. In general, in the same case for future and current cash flows and more frequent compounding at lower rates corresponds to lesser frequent compounding at a higher rate.

BEYs and the Treasury

BEYs provided to financial institutions such as the Federal Reserve and financial market institutions shouldn't be used as benchmarks for long-term bond yields. The problem isn't so much that the BEYs that are widely used aren't accurate. They have a different function; namely, they facilitate the comparison of yields for T-bills, bonds, and T-notes that mature within the same timeframe.

Discounts need to be transformed to a semi-annual bond basis (SABB) to create a precise analysis, as this is the standard basis used to calculate longer-term bonds. To calculate SABB using the same formula to calculate APY is utilized. It is the only distinction is that it takes place every year twice. Thus, APYs based on a 365-day year could be directly compared with yields based on SABB.

Conclusion

Fixed income investments can be a great source of income and, if used correctly, can help you increase your fortune, save for retirement, and leave a substantial inheritance to your family. But, they're not for those who aren't confident If you are planning to explore the world of investment, you should first decide if you have the financial capacity to risk your hard-earned cash. Being aware of your personal risk tolerance will direct you toward the most appropriate alternatives.