A Complete Guide About What is the FICO Score 8

Advertisement

Susan Kelly

Nov 23, 2023

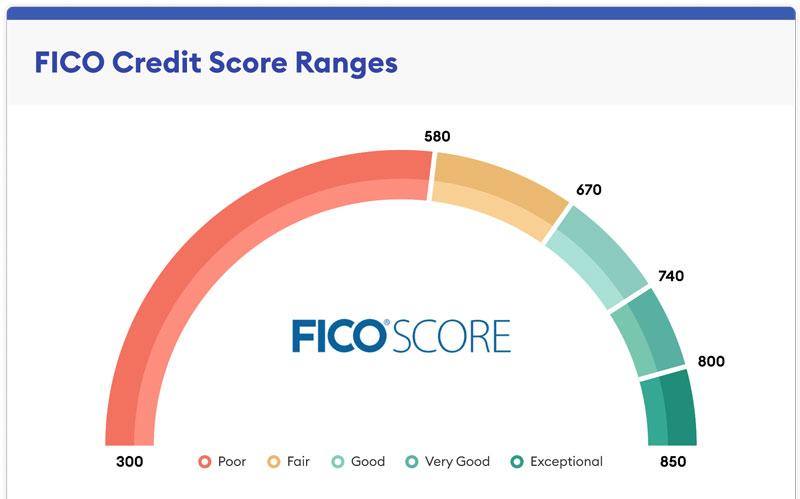

Do you want to know what is FICO Score 8? FICO Score 8 is among the many formulas developed by FICO. Fair Isaac Corporation to calculate the credit score of individual consumers. Creditors and lenders will determine whether they will loan you money or provide credit lines and interest rates based upon a range of elements, but FICO Score 8 is the most widely used. FICO Score 8 is widely believed to be a trustworthy source for credit assessment.

Although FICO first released it over 10 years in the past, the FICO Score 8 is the one used the most frequently by the three leading credit reporting companies. The lenders look over a prospective borrower's credit history and scores to decide whether to approve the lease, auto loan, and credit card request.

- The FICO-8 is an upgrade to the credit scoring framework, mainly used by the main credit bureaus.

- Its scoring standards are not as accommodating as credit card balances. However, they minimize the consequences of late payments on occasion.

- Based on their requirements, specific lenders may use different versions or customized versions for their industry using their FICO scoring process.

Usage

A perfect credit score can open a variety of possibilities for you, particularly when it comes to your financial situation. This is how one can utilize it:

- When you apply for a lease or credit card, many prospective lenders will examine their credit scores and report on your credit as a normal part of the approval process.

- Finding lower rates: The majority of lenders will charge higher rates if you have a credit history that is not in good shape. A good credit score will save you lots of money, particularly on an expensive loan such as a mortgage.

- While housing for rent is available, even if you don't intend to take out a lease, landlords might also look into applicants' credit scores when applying to rent a house.

- To sign up for utilities, In most cases, utilities assess your credit score when you sign up for their service. If you do not have an excellent rating on your credit, they could ask you to pay the amount as a deposit.

- The process of finding a job: in certain situations, a low credit score could even stop the applicant from being able to get a specific job.

Factors Affecting

FICO credit scores are determined by the information contained in the customer's credit reports. Therefore, knowing the information contained in your reports is an excellent way to begin. Credit reports include details like how frequently you pay your bills on time and the number of credit accounts you've opened. This information could directly impact the FICO Score 8 score (as scores are calculated using other credit scoring frameworks). In particular, maintaining your credit utilization at a low level can improve your FICO credit scores, but repeatedly failing to pay your credit card bills on time could hurt them.

Businesses Use for Lending Decisions

Since FICO Score 8 was initiated, two more models of the base score, i.e., FICO Scores 9 and 10, have been made available. Yet, FICO Score 8 tends to be among the most frequently utilized FICO ratings, as per the credit-scoring firm. Companies choose what kind of credit scores they use in making loan decisions. Also, utilizing FICO Score 8 could make the most sense due to the requirements it takes into contemplation.

Difference From the Rest of FICO Score Models

At the time that FICO Score 8 was launched, it had a variety of improvements from the previous version of the base FICO Score, among these:

- The high credit service ratio could impact your credit score more.

- One late payment might not affect your credit score nearly as much.

- Collections accounts are not considered when the balance at the beginning was less than $100.

When FICO Score 9 was released in 2016, the company made modifications such as:

- Medical collections reports might not have as significant an impact on the score as they do on the

- Collection accounts that are paid off do not adversely affect your credit score.

- Rent payments can impact your score if they do.

Conclusion

FICO is a formula for business that helps keep your business going even when it's going to lose money. Yet, it can generate profits through other means, such as discounts, so that one will acknowledge your business's worth. If you have a low credit score, it could stop you from getting particular positions.