The Complete Guide to Margin Trading

Advertisement

Triston Martin

Jan 15, 2024

Investors must deposit a margin with their stockbroker or exchanges to cover the risk they provide to their broker or exchange, known as a margin requirement. An investor can create credit risk when they borrow money from the dealer to acquire financial assets, borrow money to sell financial products shortly, or enter into a convertible transaction.

When investors borrow money from a broker to acquire an asset, they're known as "buying on margin." If you buy an asset on margin, you utilize your brokerage account's marginal assets as collateral for the first payment to the broker. The spread is the difference between a product or agency's list price and its manufacturing costs or the income to revenue ratio in a business environment.

For an adjustable-rate mortgage (ARM), the margin is the percentage of the interest rate added to the modification rate.

Recognizing the Concept of Margin

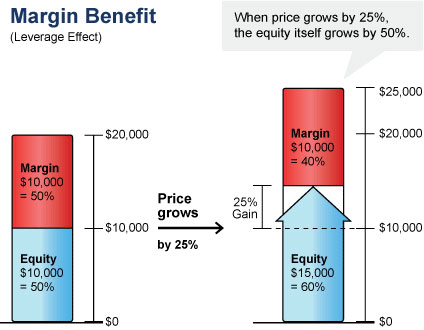

An investor's equity in their investment account is their "margin." It means borrowing money from a broker to buy stocks on "margin" or "on margin." they must open a margin account instead of a conventional brokerage account to carry out this activity. An investor with a margin account borrows money from their broker to purchase more assets than they could otherwise afford to buy with the money they have on hand. Buying securities on margin is like taking out a loan against the cash or assets you currently have in your account.

Who must pay the interest rate on a collateralized loan regularly? Because the investor is borrowing money or utilizing leverage, both gains and losses will be increased.

Purchasing at a Loss

Lending learning how to trade to buy a stock is known as "margin trading." In a sense, it's like getting a loan with your broker. It's good to purchase more stock through margin trading. You must open a margin account to trade on margin. You don't trade with the money you have in the account in this case. Who can only open margin accounts with your permission, which your broker is stopped by rules to get from you? A minimum of $2,000 is necessary to open a margin account, while some brokerages may ask for a higher amount.

The minimum margin is the amount of money that one must deposit to open an account. To keep your loan, you must pay the interest on the borrowed cash on time and in full. In a portfolio context, when you sell a stock, the proceeds are used to reimburse your broker until the loan is repaid in full.

Extra Care Is Necessary

You'll have to pay a fee to borrow funds and put collateral in your account if you use margin. You'll have to pay back your loan principal plus interest in the long run if you don't make any payments, which will add the interest to your account. The amount of money you owe grows as interest accrues over time—the interest rate rises as the number of debt increases, and so on.

Short-term investments are the most common usage of margin trading. The higher the return required to break even increases in direct proportion to the length of time you hold an investment. The odds of making money on a margin investment are against you if you retain it for an extended period.

Margin of Error

A profit margin is a difference between revenue and expenses, which is measured in terms of profitability, earnings growth, and net profit margins in the financial statements of enterprises. Using the gross profit margin, a company's revenue is compared to the cost of its products sold (COGS). It is important to note that the operating profit margin and the net profit margin both consider the total cost of goods sold and operating expenses, as well as taxes and interest.

What Is Margin Trading, and What Is It Used For?

Margin trading is placing trades using borrowed funds from a brokerage business. Margin trading involves putting up a lump sum of money as security for a loan and then making regular interest payments. Investors will be able to acquire more securities thanks to this loan, which boosts their purchasing power. The purchased securities automatically provide the collateral for the margin requirement.

What Exactly Is a Margin Call?

This is where a brokerage firm notifies an investor that they have been granted a margin loan and are being asked to raise the assets in their margin call. Margin calls frequently necessitate further financial deposits, which may be made by selling other investments. Unless the investor agrees to sell their positions, the stockbroker has the authority to do so.