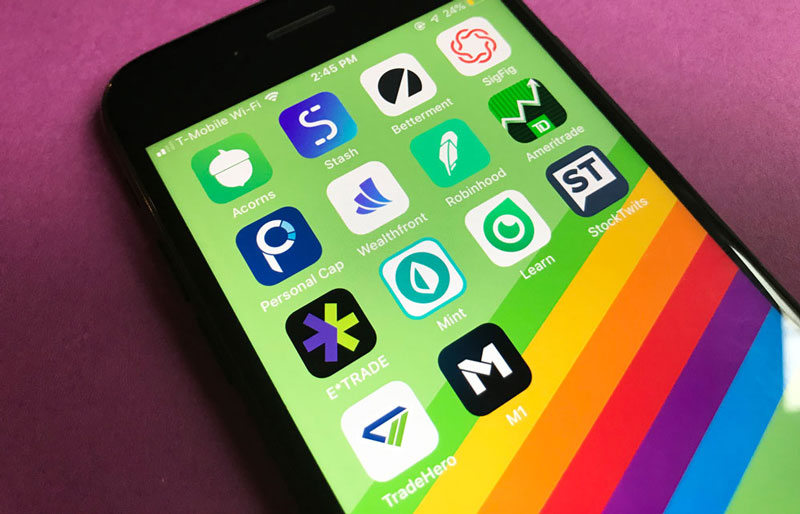

Best investment Apps of 2022: Which Is Best For You

Advertisement

Triston Martin

Feb 10, 2024

Apps that help you keep your money in order are what you want to find. A good finance app can do simple financial tasks; move money into investment accounts, and keep track of how much you spend. It can also show you how much money you have. It's easy to learn about the stock market and quickly trade stocks with apps. So many people use investment apps because they can do so much, and so many people use them. The best investment apps of 2022 that help you keep your money in order and invest it are shown in this list.

1. Betterment

The reason Betterment is so popular is that it is easy to use. People love it because it is one of the biggest and most well-known things. Professionals use the app to build portfolios for you that are made up of ETFs that are based on your risk tolerance and when you need the money. There are many ways Betterment can help you build socially responsible portfolios that are focused on climate change or social impact. If you're willing to take a little risk, the app can help you find investments that could make you more money to make more money. If you want to make your money safer, Betterment can help you! To make it even better, add a powerful (and free) cash management account to it in the next step.

2. Invstr

Learn about investing in real life and then work with a group of people to make an app that helps people who want to start but don't know-how. In the app, there's a fantasy stock game where you can help manage a virtual portfolio. There's also a place where other investors talk about stocks and other things they own.

3. Acorns

When Acorns came out, people still liked them. They were easy to use, so they kept them. There isn't much to do after you set it up. To use Acorns, you can link your debit or credit card to your account. When you buy things with your debit or credit card, Acorns will round up the total to the next dollar and invest the difference in one of a few ETF portfolios. You only have to pay $3 a month to use Acorns Personal, a free service. This includes your investment account, IRA, debit card made of metal, and other things you own.

4. Wealthbase

There are a lot of stock market games out there, but Wealthbase is a new one. Many people think it is the best app for having fun and picking out stocks. Your friends can play as long as they want. You can play for a few weeks, days, or even all day. Unlike other stock simulator apps, Wealthbase uses social media and stock pick to make it more unique. Because of this, the app is different from other simulator apps that come with your phone. Friend's choices for stocks will show up on a feed. Updates on who wins will be sent to you each day, and you can have some "trash talk" with your friends. A second thing: The app runs very well. It doesn't take long to load, and there aren't any glitches, so it doesn't take long.

5. Wealthfront

A small fee can help you manage your money through Wealthfront. It doesn't matter what kind of money you have. They can help you. Hundreds of ETFs are used to build your portfolio. As well as how much risk you want to take, Wealthfront considers when you'll need the money. As you deposit money, you'll keep your account balanced and on track for your goal. Do this as you do, and Wealthfront will take care of this for you.

6. Stockpile

Stockpile is a good app because you can buy small amounts of stocks with it. That one high-tech stock costs $300, but you can buy just half or a third of it. Stockpile doesn't charge you any fees when you buy or sell things on the site. Besides giving a gift card that can be used to purchase stock, Stockpile is also pretty cool. If you want to get a younger relative interested in investing in a fun way, this could be a good idea. You don't even need an account to send a gift. With Stockpile, you can keep an eye on their money. Please make a list of stocks your kids can buy and sell, or let them pick their own. Share the stocks you want to buy with your family and friends.

Conclusion

Apps that help people keep track of their portfolios while on the go are essential. This is how you say it: The right investment app for you should have things like minimum balances and fees in mind when you pick it out. Think about who the app is for, too. It will be very different for people who trade options than people who don't want to be in charge of their money.